I know I should ‘tune out the noise’ but I want to do something.

“Tune out the noise” is good guidance for investors in crazy times like we’re experiencing now.

Simple in theory, hard in practice.

It is okay to feel overwhelmed by the relentless stream of information on COVID-19 – whether it’s public health updates, the impact on the economy or the turbulence in share markets. We are being bombarded by 24/7 news, blogs, facebook, twitter, and podcasts.

And it’s also okay to get caught up in the emotional contagion – which is the transfer of moods and feelings from one person to another – which impacts most people, without the realisation of the social influence they are under.

This overwhelm, according to Wharton management professor Sigal Barsade, it is deadly for decision-making. “Even though the vast majority of people won’t contract the virus, a much higher percentage will experience a surge in worry, anxiety and fear” which in turn can then lead to rigidity in decision-making. “We’re not creative. We’re not as analytical, so we actually make worse decisions,” Barsade says. If you’re not aware that overwhelm and emotional contagion is influencing you, you are likely to make poorer decisions.

So, what can you do?

Here are a few things that can help you to navigate the negative news, get things in perspective, and give you a better chance of making positive life and financial decisions.

1. Categorise information into a category of relevance.

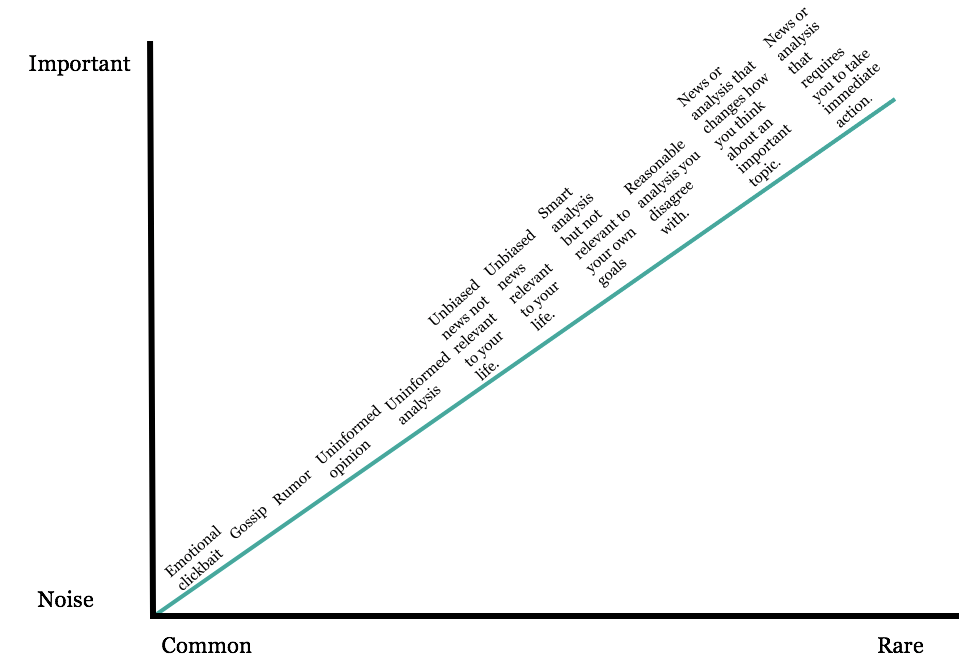

There’s a hierarchy of news and information from emotional clickbait – which is pure noise – to good relevant analysis on which you can take action. Morgan Housel, partner at the Collaborative Fund and former Wall Street Journal columnist, suggests that this hierarchy looks something like this:

“The takeaway here is that good, relevant content is extremely rare”, says Housel. You should give no attention or energy to the categories in the lower half of this chart. You also need to limit information from or conversations with non-expert sources – which tend to be short on facts and long on conjecture.

Much of what’s said about COVID-19 involves fears or stories that are mainly negative – whether it’s as seemingly small as someone complaining that they can’t buy sanitiser or relaying the latest statistics. It all feeds into the emotional contagion.

We recommend that you separate the news into that which is actionable – like guidance on staying safe from health professionals – and that which may be interesting but not actionable – like the daily gyrations of the share market.

2. Gain perspective

If you look back at past news, much of what may have seemed important at the time is now irrelevant to your decision-making. For example, take these three headlines – which remind us of a range of significant economic and market events in the past 20 years – and ask yourself this question: does this matter to me now?

The year dot.com turned into dot.bomb – The Guardian, 29 December 2000

Euro crisis spreads and puts the world economy at risk – The Guardian, 8 October 2011

Brexit casts a dark cloud over our experts’ predictions for 2019 – The UK Independent, 1 January 2019

Probably not.

It’s also important to gain perspective on share market performance. The news headlines like to report the most dramatic of declines – so the figure you’ll see is the drop in the Australian share market from its high point on 20 February 2020 – which was about 35%.

But what if instead we look at the performance for some longer timeframes. Like the 12 months to 31 March 2020, where the S&P/ASX 200 Accumulation Index returned -0.56%. And for the ten-year period, Australian shares delivered average annual returns of 4.92%.

The aim of information is to help you make better decisions towards your ultimate goals. If your goal is as short as 12 months, then you shouldn’t have funds in the share market. For most people, says Morgan Housel, the lifetime of your goals is far longer than most news headlines.

3. Realise that different people have different goals, timeframes and risk tolerance

There are millions of buyers and sellers in share markets on any given day. And each one of them is going to have different objectives, timeframes, risk tolerance and strategies in how they approach financial markets.

At one end of the spectrum are long term investors. At the other traders. Investors tend to be focused on the long-term, seeking to put money in assets that generate solid capital growth and income over time.

Traders usually have a short time horizon and are looking for price fluctuations in a security relative to the market – they’re not interested in stocks for the long-term, but notching up many short term gains.

There are all kinds of investors and many different ways to invest. What’s important is that you stay focused on your personal goals and time horizon and don’t take your cues from someone playing a different game.

4. Don’t fiddle with your portfolio

The most successful long term investors don’t spend a lot of time monitoring, analysing or trading. They recognise that investing is a long run game – not even of years, but of decades.

They also don’t over-complicate their portfolios with sexy investments. Morgan Housel puts it nicely:

“The more complicated your portfolio, the more knobs you have to fiddle with; and the more knobs you have to fiddle with, the more opportunities you have to make regrettable, emotion-based decisions”.

The constant itch to fiddle tends to come at the cost of returns. So, don’t fiddle with your portfolio.

5. Separate the actionable information from the unactionable.

The only information that you should even consider taking action on is from someone who knows who you are, your personal circumstances, your constraints, your goals, your concerns – and how the changes in the world might affect you.

Wharton’s Professor Barsade’s advice on the health front is equally relevant for your investments: “Be judicious about the conversation that you’re taking in… [turn to] experts, and even go to multiple experts. When it comes to action, she adds, take the necessary precautions, don’t do more than is needed — and don’t panic.

Conclusion

Navigating volatility is just part of being a share investor. Don’t think about dramatic downturns presenting opportunity or representing doom. It is just noise. Noise that you should feel free to tune out.

Sources: Morgan Housel ‘How to Read Financial News’ 6 December 2017; Knowledge@Wharton ‘Coronavirus: How Emotional Contagion Exacts a Toll’ 10 March 2020